Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Over the next seven years, experts predict that Costco Wholesale Corp’s EBITDA will grow at a rate of 134.67%. First, that high P/E comes at a time when sales growth has changed for the worse. In past years, Costco had consistently delivered sales growth in the high single digits or low double digits. That track record probably helped lead to its multiple expansion. Unfortunately for new buyers, a high valuation has contributed to those high returns.

Is It Time to Buy COST? Shares are up today.

The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

- To these commenters, the point of the standing tables were to get diners in and out quickly.

- Recent stocks from this report have soared up to +178.7% in 3 months – this month’s picks could be even better.

- Ultimately, Costco stock should slowly trend higher, but only at a tepid pace.

- The Price family’s new business is called PriceSmart and operates a chain of membership clubs in the Caribbean and Central America.

- In addition to retail, the company also provides many services including pharmacy, eye care, food & beverage and auto care centers.

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Costco’s sturdy balance sheet equips it to deal with cyclical downturns and tap growth opportunities. Solid cash flow generation allows it to raise dividends consistently.

More On MarketWatch

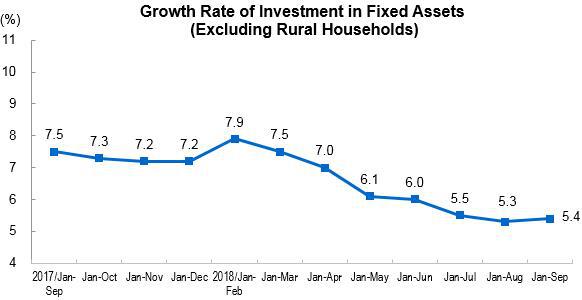

That comes after an increase of 0.2% month over month in July. Costco has risen since that time, but it grew more slowly than the S&P 500. This indicates that Buffett and his team made the right call, and considering this situation, such a performance could motivate other investors to sell or avoid the stock entirely.

- The Style Scores are a complementary set of indicators to use alongside the Zacks Rank.

- The company operates as a member-only big-box retailer claiming more than 118 million members, it is ranked #10 on the Forbes Fortune 500 list and is the 5th largest retailer internationally.

- The index for gas climbed 10.6% month over month, way more than the previous month over month increase of 0.2%.

Price Club’s first store, opened in an old Howard Hughes airplane hangar, is still in operation and known as Costco #401. The original poster mentioned going to customer service with their issue. They didn’t say anything about management’s stated reason for the replacement (or if any was provided). While some warehouses may be bringing in the standing tables in addition to their sit-down tables, it appears that only this Costco location in South Korea has completely swapped them out. The discontent this change has created, though, may prompt the company to reconsider. CPI surged 0.6% month over month in August, matching the forecast.

Costco Wholesale Corporation (COST Quick QuoteCOST – Free Report) , an “all-weather” stock, has withstood multiple market gyrations and delivered returns to investors. A resilient business model enables it to gain market share and generate profits. This operator of membership warehouses has exhibited a decent run on the bourses and has outpaced the industry year to date. Additionally, the Zacks Consensus Estimate for Costco’s current financial-year sales and EPS suggests growth of 6.7% and 9.5%, respectively, from the year-ago reported numbers. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Motley Fool Returns

This Issaquah, WA-based company, with a strong history of dividend payments as well as sound fundamentals, provides a hedge against any odd swings in the stock market. Costco continues to be one of the dominant warehouse retailers based on the expanse and quality of merchandise offered. Comparable sales for the retail month of August — the four-week period ended Aug 27, 2023 — increased 3.4%. This followed an increase of 2.5% registered in July.Costco has emerged as a viable option for bargain hunters looking for essentials and other discretionary purchases amid soaring inflation.

Although second-quarter retail visits were down slightly year-over-year, there are plenty of bright spots across the sector, according to foot traffic data from analytics company Placer.ai. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

Services

The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Southwest Airlines (LUV) Continues to Grapple With Fuel CostsThe Zacks Analyst is worried about the escalating fuel prices as they are likely to keep the bottom line under pressure.

Telsey Advisory Group Reiterates Costco Wholesale (COST … – Nasdaq

Telsey Advisory Group Reiterates Costco Wholesale (COST ….

Posted: Thu, 31 Aug 2023 07:00:00 GMT [source]

Product categories include grocery and frozen foods, apparel, sporting goods, electronics, auto care, appliances, housewares and even furniture. Nearly 70% of the stores are located in the US with another 13% in Canada and the remainder scattered around the globe. “Further progress will require easing of price pressures on these items without any flareup elsewhere.” The Consumer Price Index or CPI rose by 3.7% year-over-year in August, the Bureau of Labor Statistics reported. That’s greater than July’s year-over-year increase of 3.2% and exceeds the forecast of a 3.6% increase year over year.

Costco ended the quarter with 69.1 million paid household members and 124.7 million cardholders. After all, sales growth is moderating after several years of torrid growth, and Costco stock had nearly doubled in the 13 months before it reached its all-time high. Nevertheless, several key catalysts could launch the shares past $600 to new all-time highs in 2024. To put some numbers on it, the company produced product sales of $52.6 billion in the fiscal third quarter of 2023.

Trading volumes in the past couple of days are nearly double the 10-day average and momentum indicators are showing signs of a recovery. The Costco stock value has experienced a 17% decline so far this year (as of 31 May). This decline has been partially cushioned by COST’s recent 5-day winning streak, but the stock is tagging a relevant area of resistance that may threaten to pause this recent rally. Apple’s long-awaited iPhone 15 launch leaves investors disappointed, and Wall Street isn’t too enthused, either.

About Costco Wholesale (NASDAQ:COST) Stock

In the third quarter of fiscal 2018, membership fees brought in $737 million, compared to the roughly $1 billion noted in the most recent third quarter. Costco is a wholesale club, which basically means customers pay a fee for the privilege of shopping https://1investing.in/ at the company’s stores. This changes a lot about how this giant, global retailer operates. But, according to estimates from the two third-party forecasting services, as of 31 May, the price of Costco stock could rise in the next two to five years.

A $5 increase in the basic membership fee (and $10 increase for executive members) in the U.S. and Canada would lift Costco’s bottom line by hundreds of millions of dollars annually. That would provide a meaningful boost to earnings growth over the next two fiscal years. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. The membership numbers aren’t moving massively, but they are trending steadily higher. The goal is to keep opening new stores and, more importantly, using those stores to add more members. Roughly five years ago, Costco’s membership stood at around 51.6 million households.

In 2022, COST’s revenue was $226.95 billion, an increase of 15.83% compared to the previous year’s $195.93 billion. Woodward (WWD) Benefits from Momentum in Aerospace SegmentPer the Zacks analyst, Woodward’s performance is gaining from strength in its Aerospace segment. The Industrial segment is expected to gain from higher demand for power generation.

PREVIEW Walmart set to raise its full-year forecast as shoppers stick … – Reuters

PREVIEW Walmart set to raise its full-year forecast as shoppers stick ….

Posted: Wed, 16 Aug 2023 07:00:00 GMT [source]

Since launching its initial public offering in 1985, the stock has risen nearly 61,000%, making it one of the most successful retail stocks in history. The COVID-19 pandemic unleashed a wave of rapid sales growth for Costco, due to strong discretionary spending and the impact of inflation on the price of food and other staples. In five years, more new stores will lead to more new members and an even larger contribution from membership fees. That seems modest, but the stores have a large footprint, and each one attracts a significant number of members.

The new report also shows how much core CPI increased in August, a key inflation measure that excludes food and energy. Core CPI increased by 0.3% month over month, above the forecast of 0.2% and above July’s increase of what is turnover ratio 0.2%. In the last four years, Costco Wholesale Corp’s EBITDA has seen an increase, rising from $5.92B to $8.00B. Analysts predict that Costco Wholesale Corp’s EBITDA will increase in the upcoming year, reaching $12.26B.

But growth has slowed over the past six months, particularly in the U.S., which accounts for well over half of Costco’s sales. A conservative estimate might be for around 85 million members five years from now and, perhaps, a membership fee run rate of something like $1.25 billion. Those are back-of-the-envelope figures that project future growth into the future, and then round down. The bigger driver of Costco’s gross profits is membership fees, and if the past is any indication, management is working hard to ensure it keeps growing.

0 Comments